UK’s deforestation footprint per tonne of product consumed is higher than that of China warns Environmental Audit Committee

‘The UK is a significant consumer of commodities linked to deforestation,’ states the second report to come out of Environmental Audit Committee (EAC) investigations into global deforestation. ‘While the UK is only the 15th largest contributor to tropical deforestation in global terms, the intensity of UK consumption (in terms of footprint per tonne) is higher than that of China.’

Commodities linked to deforestation include products such as soya, cocoa, palm oil, beef and leather. The impacts of mining must also be considered.

UK Government’s Sustainable timber and deforestation inquiry

In September 2022, the EAC asked Woodknowledge Wales to provide written evidence to the UK Government’s Sustainable timber and deforestation inquiry. Results were fed back to the EAC investigations.

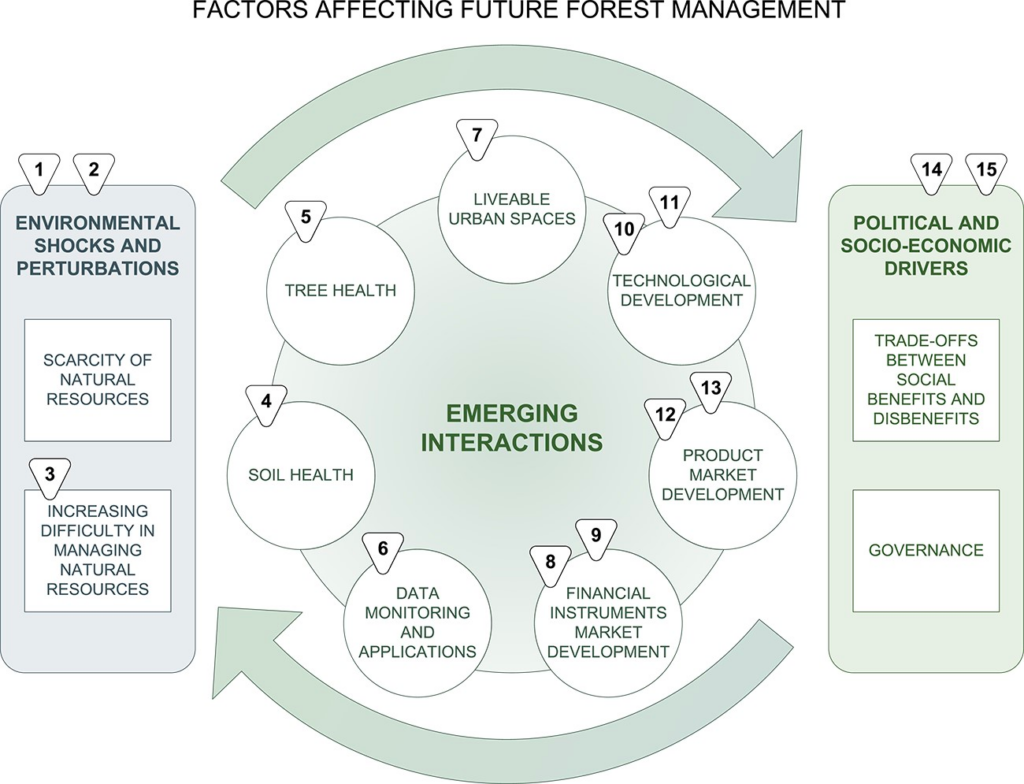

“Novel resilient forested landscapes are misunderstood. The topic needs resources, joined-up and critical thinking,” wrote Dainis Dauksta, Specialist Advisor Wood Science in his original response.

Now, the Committee has published a second report that looks at ‘The UK’s contribution to tackling global deforestation‘.

It is important to note the distinction between deforestation and forest degradation. There is a common misconception that harvesting timber from forests is a major direct cause of full deforestation. This is not the case. The overwhelming driver of global deforestation, especially in biodiverse tropical forests, is the rising global demand for agricultural commodities, and that is the full focus of this valuable EAC report which delivers recommendations to Government from the House of Commons Committee. The Government has two months to respond.

“I welcome the publication of the UK Parliament Environmental Audit Committee report on The UK’s contribution to tackling global deforestation. This report is important and timely given the high rate at which the UK is importing commodities such as soya and palm oil produced from crops grown on land that has recently been deforested in the tropics. It is essential that the UK fully addresses the global environmental impact of the commodities that it imports including its exceptionally high rate of timber imports (predominantly from temperate and boreal forests). There is a very strong environmental case that the UK should prioritise increasing its domestic production of timber through increasing its area of conifer production forests,” said John Healey, Woodknowledge Wales’ Board Member.

EAC recommends Government work with international partners to improve oversight in the UK and globally

The EAC recommends that the Government work with international partners to improve oversight in the UK. The report calls on Ministers to develop a Global Footprint Indicator to demonstrate this impact to the public, and a target to reduce the UK’s impact on global deforestation. By understanding our national impact on global forests, it is hoped that consumers may be inspired to take action and change those habits that drive this unsustainable level of demand.

While the Government has committed to the certification of forest-based commodities sold into the UK, the EAC is concerned this new regime isn’t being implemented quickly enough, nor is it broad enough. The report recommends that other forest-risk commodities, such as maize, rubber and coffee are included in the sustainable product certification regime and that legislation prohibit financial trading of all forest-risk commodities.

Chair comment

Environmental Audit Committee Chair, Rt Hon Philip Dunne MP, said:

“UK consumption is having an unsustainable impact on the planet at the current rate. UK markets must not be flooded with products that threaten the world’s forests, the people whose livelihoods rely on them and the precious ecosystems that call them home. Yet despite the recent commitment before and at COP28 to invest more in reforestation measures and The Amazon Fund to help halt the speed of global deforestation, the UK needs to take tangible steps to turn the dial at home.

“The Government’s ambition and stated commitment at COP26 to halt deforestation by 2030 was very welcome: but it is not on track now. Its legislation for a regime to require certain products to be certified as ‘sustainable’ before they can be sold in UK markets was welcome: but the implementing legislation has still not come forward. There is little sense of urgency about getting a rapid grip on the problem of deforestation, which needs to match the rhetoric.

“Countries all around the world contribute to deforestation, and the international community of course needs to do much more to tackle deforestation. Yet on some measures the intensity of UK consumption of forest-risk commodities is higher than that of China: this should serve as a wake-up call to the Government. To demonstrate genuine global leadership in this critical area, the UK must demonstrate domestic policy progress, and embed environmental and biodiversity protections in future trade deals.”

- Read the report

- Read the report summary

- Read the report (PDF)

- Read all publications related to this inquiry, including written and oral evidence